More Companies Are Talking About ESG

This year’s biggest corporate buzzword isn’t actually one word but three: environmental, social, and governance — also known as ESG. From conference calls to corporate filings, more companies are talking about ESG than ever before.

What the data says about Environmental Social Governance (ESG)

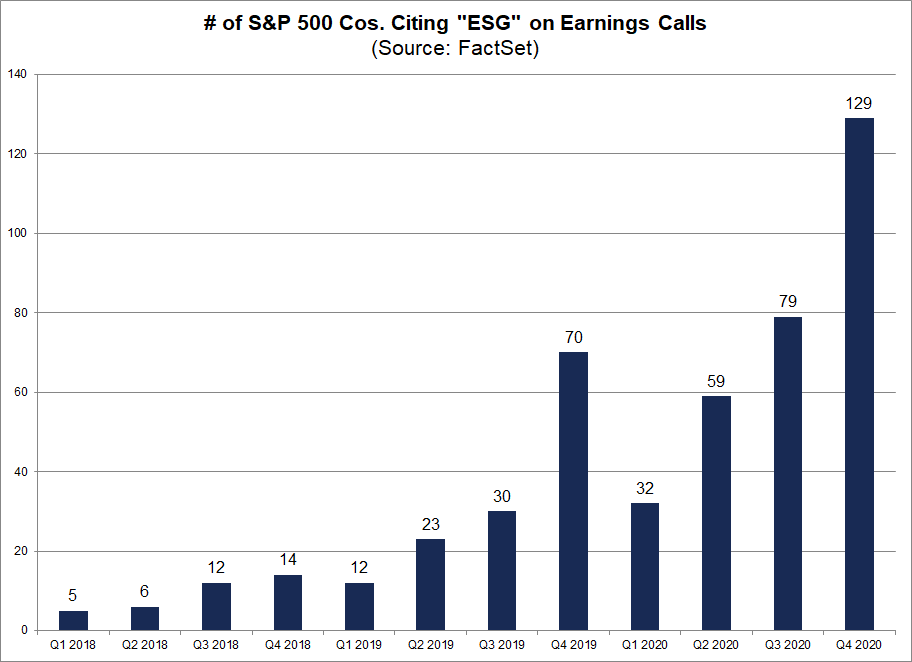

Financial data and software company FactSet searched the transcripts of all the S&P 500 companies that conducted earnings calls for Q4 2020 to see how many mentioned the term “ESG”. Of these companies, more than one in four cited “ESG”.

This represents a 63% increase in ESG mentions from the previous quarter, and the highest number of ESG mentions in the last ten years. (The previous record was 79, in Q3 2020.)

Source: FactSet Insight

While ESG mentions increased across all 11 sectors in the S&P 500, Industrial (+10) saw the largest increase in ESG mentions on earnings calls in Q4 compared to Q3. This was followed by Health Care (+8), Financials (+7), and Information Technology (+7).

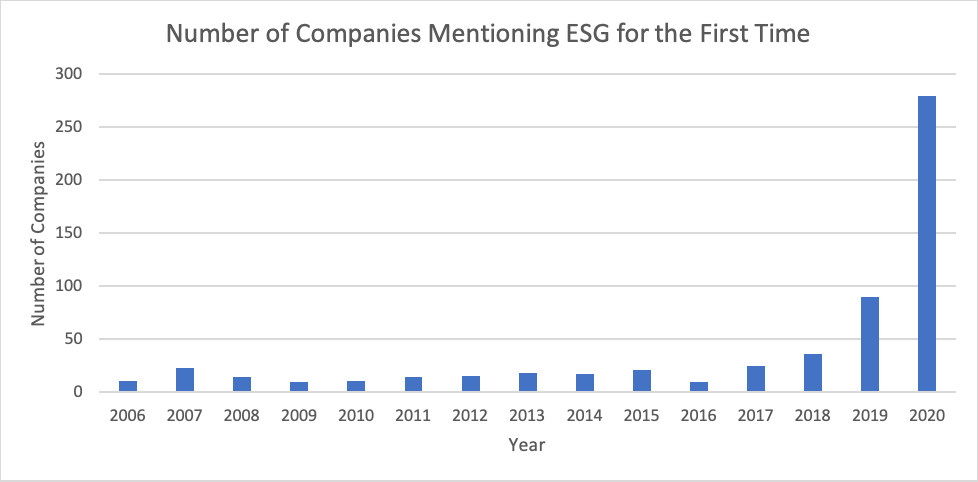

This finding is echoed by new data from Social Market Analytics (SMA) and S&P Global Market Intelligence. SMA looked at the number of times ESG was mentioned in SEC filings, which include quarterly and annual financial reports. In 2020, 481 documents mentioned ESG. By contrast, only 12 documents mentioned ESG in 2006.

SMA also looked at the number of companies that mentioned ESG in their filings for the first time. Notably, 279 companies mentioned ESG for the first time in 2020. That’s more than triple the number of companies that mentioned ESG for the first time in 2019. For comparison, the number of companies mentioning ESG for the first time between 2006 and 2018 was between 10 and 36. This finding suggests that more companies are acknowledging a link between ESG and financial performance.

The industry with the highest percentage of companies mentioning ESG in their filings was Financials (18%), followed by Energy (14%) and Industrials (14%).

Source: Social Market Analytics

Corporations aren’t the only ones talking about ESG. The increase in data availability is also driving a surge in ESG investing. In 2020, over a third of inflows into global funds were invested using ESG strategies, according to World Finance. This is not exactly surprising given that 40% of ESG and sustainable funds made top-quartile returns in the first half of the year.

Why does it matter if people are talking about ESG?

So, what does it all mean? First, the consistent increase in ESG mentions over the last several years suggests that ESG is here to stay. And, as we continue to live with the evidence of climate change and social injustice, calls to address environmental, social, and governance factors will only intensify.

Boardroom recordings reveal that CEOs see the rise of ESG as an indicator of where the business landscape is headed. Investors have seen during the pandemic how vulnerable big companies can be to a disruption in their operations — be it a global virus that shuts down supply chains or a natural disaster like a wildfire or flood. What is extremely clear is that businesses must operate sustainably in order to survive in today’s uncertain environment.

And with more investors signaling their interest in adding sustainable companies to their portfolios, it is likely that ESG will only increase in prominence.

That also explains why more companies are linking executive pay to ESG performance. Both companies and investors understand that ESG is something they should be ready to capitalize on and talk about.

Of course, talk is cheap and the true test will be whether companies manage to achieve meaningful improvements in their ESG performance. That will mean setting clear and measurable KPIs. Investing in the skills and technology to analyze the data. Providing managers with better visibility into ESG metrics so they can understand and act on the information.

We’ll keep an ear to the ground to see where the conversation goes from here.