17 Major Companies Linking Executive Pay to ESG Performance

Last month, Chipotle became the latest in a growing line of companies linking executive pay to ESG performance. Apple also announced plans to tie executive bonuses to sustainability targets earlier this year. Meanwhile, Alcoa, Intel, and Shell have had similar commitments for some time now.

Today, 89% of investors agree the inclusion of sustainability metrics is important in both annual and long-term executive incentive plans, while 88% of consumers will be more loyal to a company that supports social or environmental issues. Here’s a list of 17 companies that have already started linking executive pay to ESG and sustainability performance.

Companies linking executive compensation to ESG performance

- Alcoa

- Apple

- BP

- Chipotle

- Clorox

- Danone

- Exelon

- Intel Corporation

- McDonald’s

- National Grid

- PepsiCo

- Shell

- Siemens

- Starbucks

- Suncor Energy

- Unilever

- Xcel Energy

Alcoa

In 2013, Alcoa became one of the first companies to link executive pay to sustainability performance when it announced that 20% of executive cash compensation would be tied to its safety, environmental stewardship, and diversity goals.

Apple

Apple announced in January that it plans to increase or decrease executive bonuses by up to 10% depending on progress toward its ESG targets. Although the tech giant didn’t specify which metrics would be used, it recently unveiled a new net-zero commitment. Executive bonuses are likely to be linked to this goal.

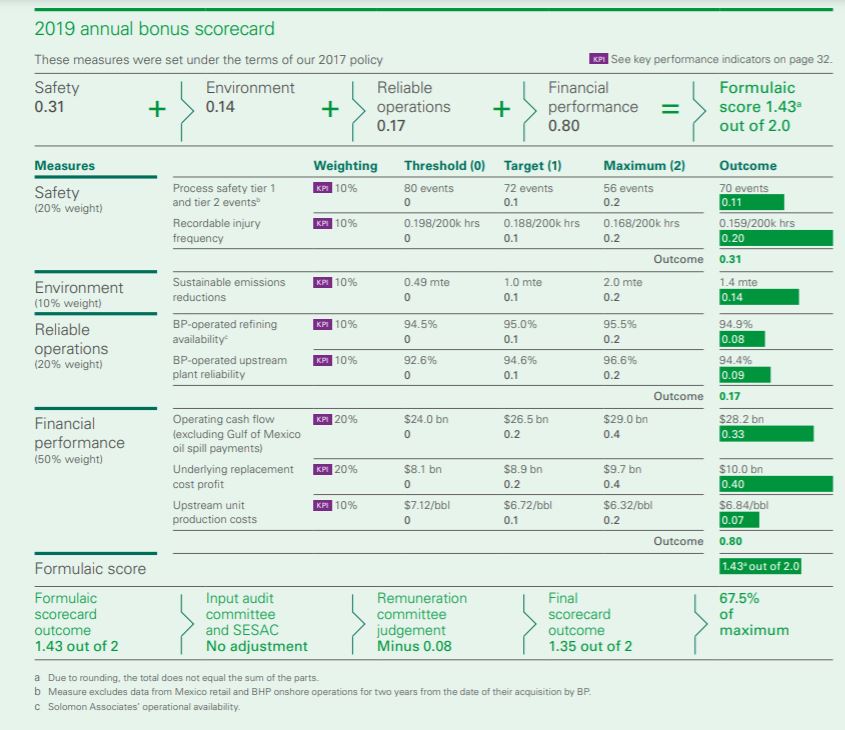

BP

BP executives’ annual bonus is based on a performance scorecard which includes an environmental target. In 2020, BP increased the weighting for the environmental target from 10% to 20%.

Source: BP Directors’ Remuneration Report 2019

Chipotle

Chipotle Mexican Grill announced in March that it introduced a new metric that ties executive compensation to ESG goals. Going forward, 10% of officers’ annual incentive bonus will be linked to the company’s progress toward achieving its sustainability goals.

Clorox

Clorox unveiled its new IGNITE plan in 2019, which integrates ambitious new ESG goals into its business strategy, among other things. The plan includes “compensation awards tied to elements of the ESG goals for members of the Clorox Executive Committee,” according to a Clorox news release.

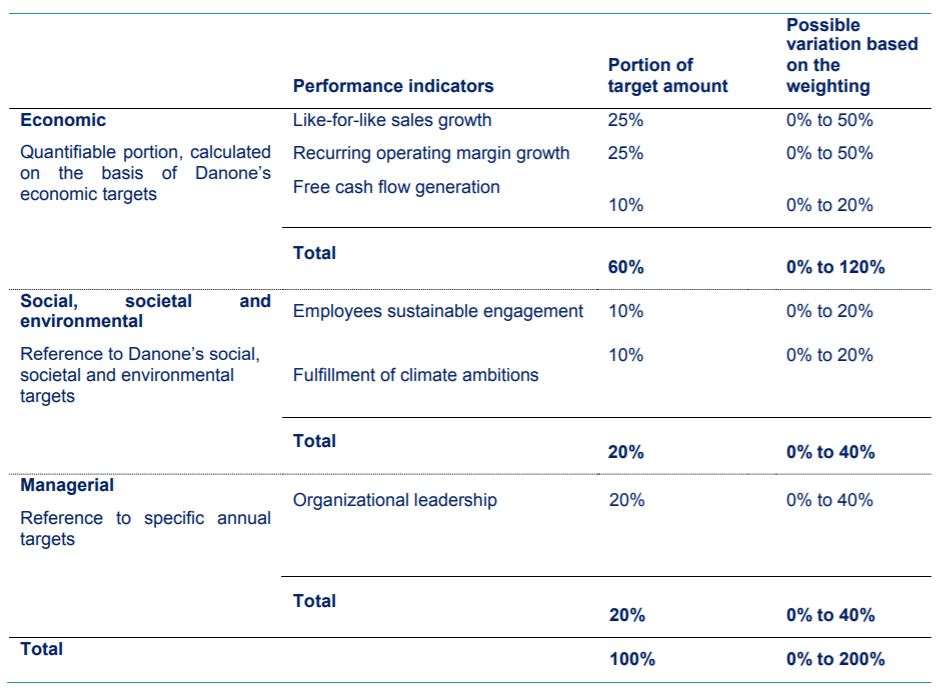

Danone

World-leading food company Danone links 20% of its executives’ annual variable compensation to its social, societal, and environmental targets. Its long-term share awards are also based in part on Danone’s CDP Climate scores over three consecutive years.

Source: Danone 2020 Compensation for the Chairman and Chief Executive

Exelon

Exelon, a Fortune 100 energy company, rewards its executive team for “meeting non-financial performance goals, including safety targets, GHG emissions reduction targets, and goals engaging stakeholders to help shape the company’s public policy positions.”

Intel Corporation

Intel ties short-term incentives for senior executives to its ESG performance. Likewise, the tech company has incorporated progress on its sustainability goals into its employee bonus program since 2008. These include goals related to diversity and inclusion, employee experience, climate change, and water stewardship.

McDonald’s

Starting in 2021, McDonald’s will factor diversity goals into its executive bonuses. The fast food empire aims to reach gender parity in leadership by 2030, as well as increase the number of executives from underrepresented groups to 30% by 2025.

National Grid

Since 2009, National Grid has tied executive compensation to performance on the company’s greenhouse gas (GHG) reduction goals. The electricity and gas utility made waves with its aggressive goal of slashing emissions by 80% by 2050.

PepsiCo

In 2006, PepsiCo launched “Performance with Purpose” integrating sustainability into daily business operations. PepsiCo’s executive bonus program directly links bonus awards to its success in achieving sustainability goals.

Shell

Royal Dutch Shell announced in December 2018 that it would tie executive compensation to short-term carbon emissions targets starting in 2020. It was the first energy company to link executive pay to carbon emissions.

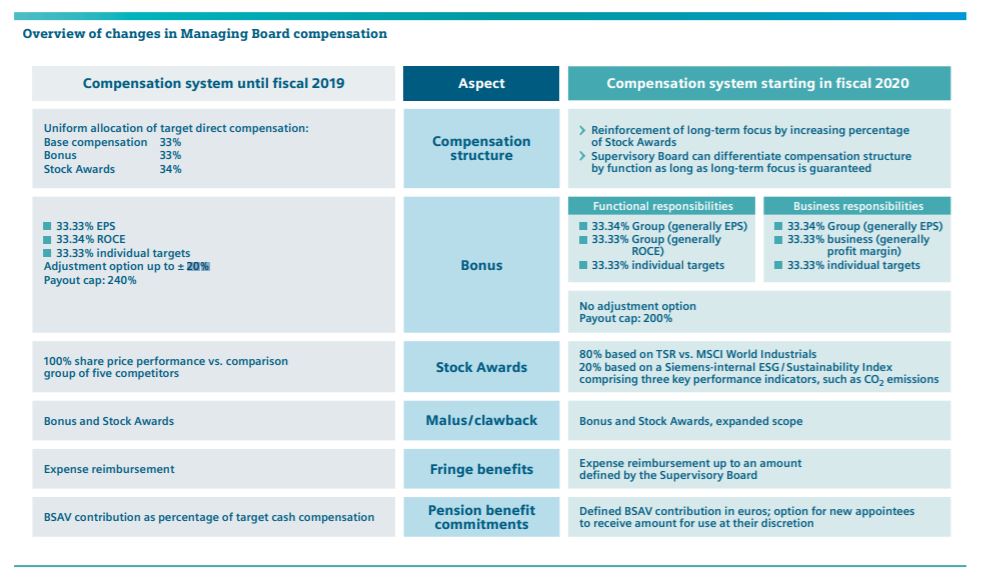

Siemens

As part of Siemens’ management compensation system, 20% of stock awards are based on an internal ESG/Sustainability Index that revolves around three key performance indicators, including CO2 emissions.

Source: Siemens Annual Report 2019

Starbucks

In an October 2020 letter to employees, Starbucks CEO Kevin Johnson said the company would “hold ourselves accountable at the highest levels of the organization” by connecting executive pay to the success of its inclusion and diversity efforts “effective immediately”. The company aims to increase BIPOC representation to at least 30% at the corporate level and 40% of all retail and manufacturing roles by 2025.

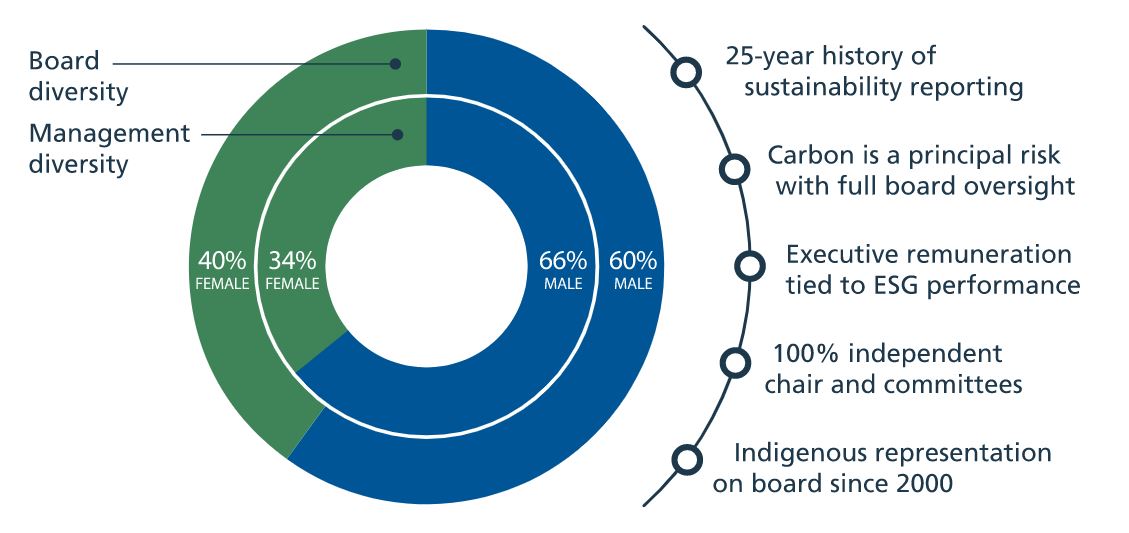

Suncor Energy

The energy company, which has a 25-year history of sustainability reporting, has developed a “robust governance structure” which includes executive remuneration tied to ESG performance. Since 2017, Suncor’s executive management team has included a chief sustainability officer.

Source: Suncor

Unilever

Unilever, a sustainability leader, ties part of its CEO’s bonus to its ESG targets. The company made headlines in 2014 when its CEO, Paul Polman, received a $722,000 bonus for his work leading the company’s sustainability plan.

Xcel Energy

The Minneapolis-based utility company ties executive compensation directly to “reliability, cost management, customer satisfaction, public and employee safety, achievement of carbon emission reduction goals and financial performance”. In 2018, CEO Ben Fowke earned an annual cash-incentive bonus of $2.9 million for the company’s employee and public safety performance.

Conclusion

By linking executive pay to ESG performance, organizations can hold their leaders accountable and demonstrate to employees and customers that they take sustainability seriously. Investors, too, want to see executive compensation tied to ESG performance. (No surprise there, given that strong ESG performance is linked to higher shareholder returns.)

As ESG becomes more mainstream, we can expect to see more organizations following these companies’ lead and integrating social and environmental metrics into their executive compensation plans.

Next, learn about the difference between sustainability and ESG.